mississippi income tax rate

4 on the next 5000 of taxable income. The corporate rates and brackets match the individual rates and brackets and the.

Strengthening Mississippi S Income Tax Hope Policy Institute

Be the First to Know when Mississippi Tax Developments Impact Your Business or Clients.

. Mississippi also has a 400 to 500 percent corporate income tax rate. However the statewide sales tax of 7 is slightly above the national average. See Whats Been Adjusted For Income Tax Brackets In 2022 vs.

Mailing Address Information. Mississippi Sales and Use Taxes Sales Tax All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax 7 unless the law exempts the item or provides a reduced rate of tax for an item. There is no tax schedule for Mississippi income taxes.

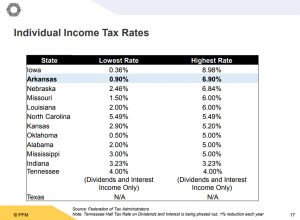

If you move after filing your Mississippi income tax return you will need to notify the Department of Revenue of your new address by letter to. Ad Compare Your 2022 Tax Bracket vs. The personal income tax which has a top rate of 5 is slightly lower than the national average for state income taxes.

The next 5000 of taxable income is taxed at 4. The Mississippi Income Tax Mississippi collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Tax rate of 4 on taxable income between 5001 and 10000.

Mississippi Income Tax Range. Currently the corporate income tax rates are 3 percent for the first 5000 4 percent for the next 5000 and 5 percent on anything beyond 10000. 3 on taxable income from 4001 to 5000 High.

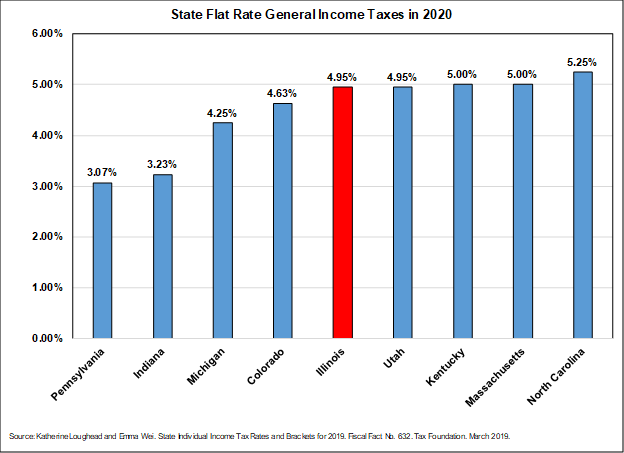

Eligible Charitable Organizations Information. The Mississippi corporate tax rate is changing. Mississippis maximum marginal corporate income tax rate is the 3rd lowest in the United States ranking directly below North Dakotas 5200.

As you can see your income in Mississippi is taxed at different rates within the given tax brackets. Box 23050 Jackson MS 39225-3050. Unlike the Federal Income Tax Mississippis state income tax does not provide couples filing jointly with expanded income tax brackets.

Mississippi has a 700 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 707 percent. Mississippis income tax currently has three marginal rates of 3 percent 4 percent and 5 percent. At what rate does Mississippi tax my income.

The chart below breaks down the Mississippi tax brackets using this model. Mississippi has a graduated individual income tax with rates ranging from 400 percent to 500 percent. Your 2021 Tax Bracket To See Whats Been Adjusted.

Hurricane Katrina Information. Does Mississippi have a minimum corporate income tax. If you are receiving a refund PO.

Mississippi individual income tax rates vary from 0 to 5 depending upon filing status and taxable income. Single Tax Brackets Married Filing Jointly Tax Brackets For earnings between 100000 and 500000 youll pay 3 For earnings between 500000 and 1000000 youll pay 4 plus 12000 For earnings over 1000000 youll pay 5 plus 32000. Here is information about Mississippi Tax brackets from the states Department of Revenue.

Mississippis sales tax rate consists of a state tax 7 percent and local tax 007 percent. Ad Comprehensive Research Platform Accurate Time-saving Software For PlanningCompliance. Corporate Income Tax Division.

Corporate and Partnership Income Tax Help. 3 on the next 2000 of taxable income. These rates are the same for individuals and businesses.

Other things to know about Mississippi state taxes The state also collects taxes on cigarettes and. For single taxpayers living and working in the state of Mississippi. The first 4000 of taxable income is exempt.

We can also see the progressive nature of Mississippi state income tax rates from the lowest MS tax rate bracket of 0 to the highest MS tax rate bracket of 5. And all taxable income. 5 on taxable income over 10000 Beginning in 2022 there is no tax on the first 5000 of taxable income.

The Mississippi State Tax Tables below are a snapshot of the tax rates and thresholds in Mississippi they are not an exhaustive list of all tax laws rates and legislation for the full list of tax rates laws and allowances please see the Mississippi Department of Revenue website. The next 1000 is taxed at 3. Mississippi has a graduated tax rate.

How do I compute the income tax due. Combined Filers - Filing and Payment Procedures. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5.

This marginal tax rate means that. 5 on all taxable income over 10000. 0 on the first 3000 of taxable income.

Your average tax rate is 1198 and your marginal tax rate is 22. In general Mississippi businesses are subject to. Any income over 10000 would be taxes at the highest rate of 5.

Mississippi has a graduated income tax rate and is computed as follows. The tax is based on gross proceeds of sales or gross income depending on the type of business. All other income tax returns P.

Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5000 spread across three tax brackets. Box 23058 Jackson MS 39225-3058. Tax Rate Income Range Taxes Due 0 0 - 4000 0 within Bracket 3 4001 - 5000 3 within Bracket 4 5001 - 10000 4 within Bracket 5 10001 5 over 10000.

If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472. Mississippi Governor Tate Reeves R in his budget proposal for fiscal year FY 2022 has announced his goal of phasing out the states income tax by 2030. Tax rate of 0 on the first 5000 of taxable income.

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Individual Income Tax Structures In Selected States The Civic Federation

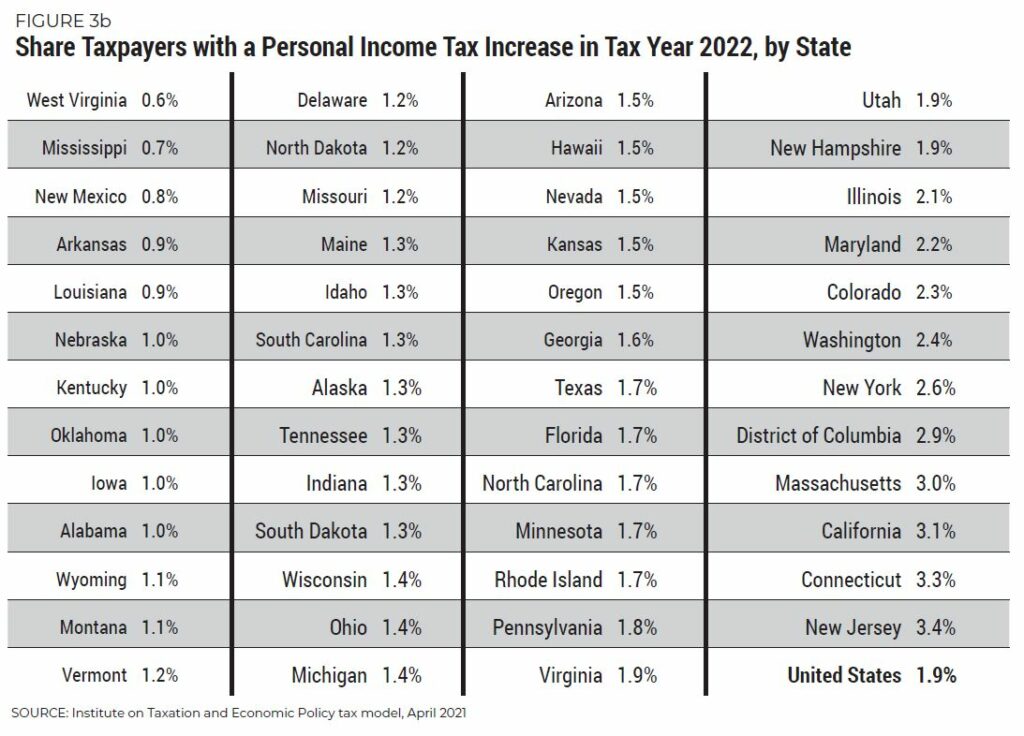

Mississippi Who Pays 6th Edition Itep

Tax Rates Exemptions Deductions Dor

State Corporate Income Tax Rates And Brackets Tax Foundation

Historical Mississippi Tax Policy Information Ballotpedia

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

It S All About The Context A Closer Look At Arkansas S Income Tax Arkansas Advocates For Children And Families Aacf

Mississippi Income Tax Calculator Smartasset

Mississippi Tax Rate H R Block

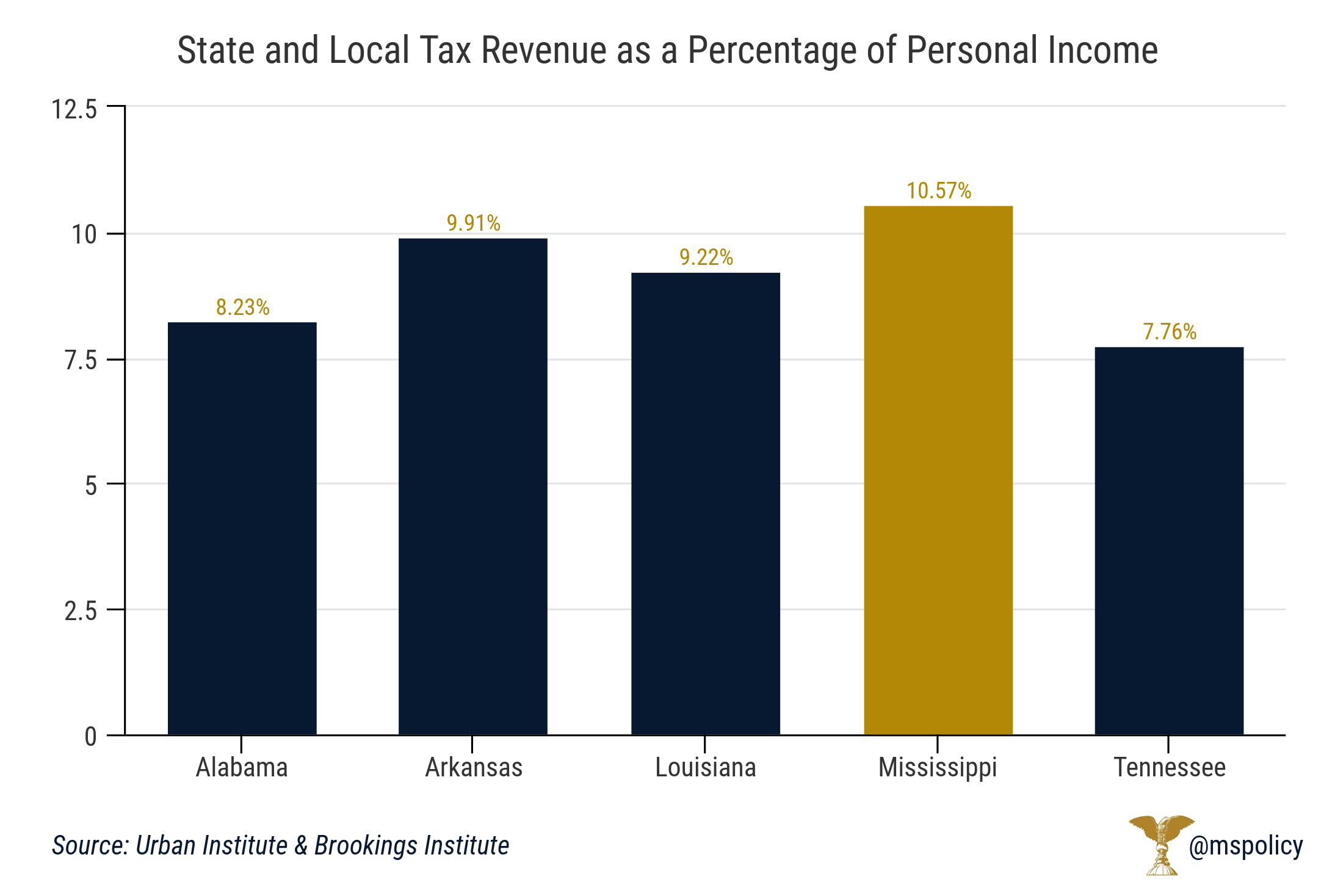

Mississippians Have Among The Highest Tax Burdens Mississippi Center For Public Policy

Mississippi Tax Rate H R Block

Tax Rates Exemptions Deductions Dor

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog